What Is The Sales Tax On Prepared Food In Nc . Listed below by county are the total (4.75% state rate. Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states. Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, and applies to any. Web this tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, by any retailer with. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. It is a specific tax rate. Web 35 rows sales and use tax rates effective october 1, 2020. Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. Web a 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use, or consumption of qualifying food.

from www.chegg.com

Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states. Web this tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, by any retailer with. Web 35 rows sales and use tax rates effective october 1, 2020. Web a 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use, or consumption of qualifying food. Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, and applies to any. Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. It is a specific tax rate. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Listed below by county are the total (4.75% state rate.

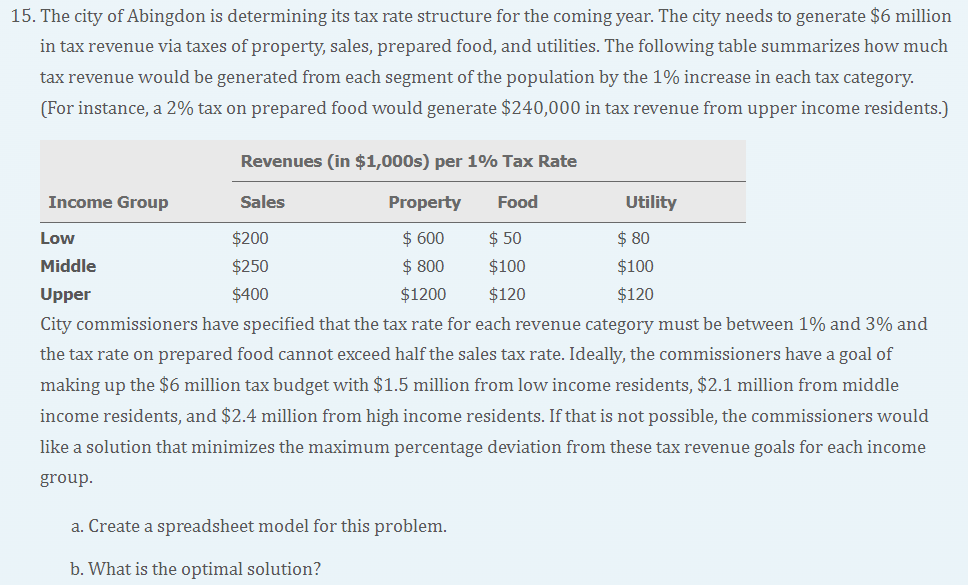

Solved 15. The city of Abingdon is determining its tax rate

What Is The Sales Tax On Prepared Food In Nc Web 35 rows sales and use tax rates effective october 1, 2020. It is a specific tax rate. Web this tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, by any retailer with. Listed below by county are the total (4.75% state rate. Web 35 rows sales and use tax rates effective october 1, 2020. Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, and applies to any. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. Web a 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use, or consumption of qualifying food. Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states.

From www.formsbank.com

Prepared Food And Beverage Tax Return Form City Of Salem printable What Is The Sales Tax On Prepared Food In Nc Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web 35 rows sales and use tax rates effective october 1, 2020. Web this tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, by any retailer with. Listed. What Is The Sales Tax On Prepared Food In Nc.

From www.formsbank.com

Tax Return Prepared Food & Beverage Tax Form Mecklenburg County What Is The Sales Tax On Prepared Food In Nc Web 35 rows sales and use tax rates effective october 1, 2020. Web a 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use, or consumption of qualifying food. Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, and applies. What Is The Sales Tax On Prepared Food In Nc.

From www.uslegalforms.com

NC Tax Return Prepared Food & Beverage Tax 2013 Fill out Tax Template What Is The Sales Tax On Prepared Food In Nc Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states. Web north carolina food tax refers to the sales and use tax applied to certain food items within the. What Is The Sales Tax On Prepared Food In Nc.

From lonaqmarice.pages.dev

Ct Tax 2024 Terza What Is The Sales Tax On Prepared Food In Nc Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states. It is a specific tax rate. Listed below by county are the total (4.75% state rate. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web a 2.00%. What Is The Sales Tax On Prepared Food In Nc.

From www.exemptform.com

How To Get A Sales Tax Certificate Of Exemption In North Carolina What Is The Sales Tax On Prepared Food In Nc Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on. What Is The Sales Tax On Prepared Food In Nc.

From www.templateroller.com

Download Instructions for Form STMAB4 Sales Tax on Meals, Prepared What Is The Sales Tax On Prepared Food In Nc It is a specific tax rate. Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web 35 rows sales and use tax rates effective october 1, 2020.. What Is The Sales Tax On Prepared Food In Nc.

From bearyflowerparadise-orders.blogspot.com

nc sales tax on food items Valencia Staley What Is The Sales Tax On Prepared Food In Nc Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. Web 35 rows sales and use tax rates effective october 1, 2020. Web this tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, by any retailer with. It is a. What Is The Sales Tax On Prepared Food In Nc.

From bluevirginia.us

Who’s Behind the “Stop the Food Tax” Organization in Fairfax County What Is The Sales Tax On Prepared Food In Nc Web a 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use, or consumption of qualifying food. It is a specific tax rate. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Listed below by county are the total (4.75%. What Is The Sales Tax On Prepared Food In Nc.

From www.ksn.com

Kansas customers experience extra charges after new food sales tax What Is The Sales Tax On Prepared Food In Nc Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many. What Is The Sales Tax On Prepared Food In Nc.

From www.theadvertiser.com

Whole Foods collecting the right amount of sales tax What Is The Sales Tax On Prepared Food In Nc Web a 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use, or consumption of qualifying food. Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, and applies to any. It is a specific tax rate. Web this tax is. What Is The Sales Tax On Prepared Food In Nc.

From www.reddit.com

Whole foods receipt breaks down where the sales tax is going r What Is The Sales Tax On Prepared Food In Nc Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web a 2.00% local rate of sales or use tax applies to retail sales and purchases for storage, use,. What Is The Sales Tax On Prepared Food In Nc.

From twitter.com

N.C. Dept of Revenue on Twitter "We invite you to attend our Sales and What Is The Sales Tax On Prepared Food In Nc Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states. Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, and applies to any. It is a specific tax rate. Web this tax is applicable to all prepared food. What Is The Sales Tax On Prepared Food In Nc.

From www.ualrpublicradio.org

Rep. David Ray discusses issues the legislature will address in special What Is The Sales Tax On Prepared Food In Nc Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states. It is a specific tax rate. Web this tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, by any retailer with. Listed below by county are the total (4.75% state rate.. What Is The Sales Tax On Prepared Food In Nc.

From www.formsbank.com

Tax Return Prepared Food & Beverage Tax Mecklenburg County 2013 What Is The Sales Tax On Prepared Food In Nc Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. Web while north carolina's sales tax generally applies to most transactions, certain items have special treatment in many states. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at. What Is The Sales Tax On Prepared Food In Nc.

From www.formsbank.com

Prepared Food And Beverage Tax Return City Of Salem, Virginia What Is The Sales Tax On Prepared Food In Nc Web 35 rows sales and use tax rates effective october 1, 2020. Web north carolina food tax refers to the sales and use tax applied to certain food items within the state. It is a specific tax rate. Listed below by county are the total (4.75% state rate. Web while north carolina's sales tax generally applies to most transactions, certain. What Is The Sales Tax On Prepared Food In Nc.

From cdispatch.com

Restaurant tax Some restaurants still collecting expired sales tax What Is The Sales Tax On Prepared Food In Nc Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, and applies to any. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web this tax is applicable to all prepared food and beverages sold. What Is The Sales Tax On Prepared Food In Nc.

From fivesenses00.blogspot.com

How To Add 9 Percent Sales Tax William Hopper's Addition Worksheets What Is The Sales Tax On Prepared Food In Nc Listed below by county are the total (4.75% state rate. Web prepared meals tax in north carolina is a 1% tax [when?] that is imposed upon meals that are prepared at restaurants. Web this tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, by any retailer with. It is a. What Is The Sales Tax On Prepared Food In Nc.

From www.formsbank.com

Prepared Food & Beverage Tax Return Form printable pdf download What Is The Sales Tax On Prepared Food In Nc Web 35 rows sales and use tax rates effective october 1, 2020. Web a 1% tax is applicable to all prepared food and beverages sold at retail for consumption, on or off the premises, and applies to any. Listed below by county are the total (4.75% state rate. Web a 2.00% local rate of sales or use tax applies to. What Is The Sales Tax On Prepared Food In Nc.